- Home

- Information Centre

- The Problem With Causes Who Dont Submit To Sars

The problem with Causes who don't submit to SARS

The Social Sector has gone under the radar when it comes to tax issues.

DID YOU KNOW? We've found that 8 out of 10 Causes who register on forgood DON'T get approved because they don't have Tax Clearance from SARS.

There seems to be a misconception that NGO's don't need to submit tax returns to SARS because they don't pay tax or they don't have an active source of income (they don't make money). This is not true. In fact, there was some recent media coverage about SARS beginning to look into tax compliance of religious bodies and it's just a matter of time before the sector comes under further scrutiny.

An example of more stringent control measures by SARS is the possible requirement for an external accountant / auditor to issue S18A Audit Certificates. Causes who have not registered with SARS may have got away with it in the past, but these gaps are being swiftly closed.

Problems you may have if you are not registered with SARS:

• You may lose out on funders because you don't have Tax Clearance

• You may lose your PBO Status

• Staff may need to claim UIF and will be unable to do so

• Your credibility comes into question

• You may be losing out on specific tax benefits

NOTE:

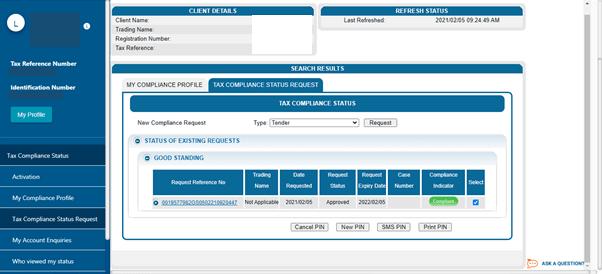

SARS no longer issues a Tax Clearance Certificate. Proof of tax clearance is issued in the form of a "Tax Clearance Pin Letter". This document is accessible via eFiling.

Understanding the tax compliance status functionality on eFiling:

Download the guide from SARS here.

Do you need help with compliance?

Email reza@tpcsa.co.za from Turning Point Chartered Accountants - they can help with specific financial reporting, tax and compliance needs.

A quick look at steps to get your TCP Pin on e-filing, courtesy of Turning Point Chartered Accountants:

Making sure you're on top of compliance issues and are in good standing with SARS is critical. If you have any questions on this matter - let us know!